Life of a fresher architect is challenging. Starting salary might be decent but not sufficient. Yearly increment is not at par with other industry standards. Is there any way out?

Perhaps yes!

It’s about investing in stock market. Essentially it is a risk worth taking. Non-risk taking investment options are investing money in gold, fixed-deposit and mutual fund. However, Return On Investment (ROI) is very low. For example, ROI for fixed-deposit is 7%. But inflation rate is about 5% in India. What is inflation? 5% inflation means you have to pay Rs. 105 if you buy next year for the same product with value of Rs. 100 today. Investing in right stocks can fetch you ROI of 25%. Seems magical? It it is but you have to learn it.

Investing in stock market is panacea for architects.

Question: How is investing in share market good for architects?

ChatGPT: Investing in the stock market can potentially be beneficial for architects, just as it can be for individuals in various professions. Here are a few reasons why investing in the stock market could be advantageous for architects:

1. Diversification: Architects typically earn income from their professional work and projects. By investing in the stock market, architects can diversify their income sources and potentially generate additional returns. This diversification can help architects manage risk and reduce dependence on a single income stream.

2. Wealth accumulation: Investing in the stock market offers the potential for long-term wealth accumulation. Architects can invest their savings or additional income in stocks, which have historically provided competitive returns over the long run. By building a well-diversified portfolio of stocks, architects can benefit from the growth of various industries and companies.

3. Retirement planning: Architects, like any other professionals, need to plan for their retirement. Investing in the stock market can be an effective way to grow a retirement portfolio over time. By regularly investing in stocks and taking advantage of compounding returns, architects can potentially build a substantial retirement fund to support their lifestyle after they stop working.

4. Exposure to the construction industry: Architects have specialized knowledge and expertise in the construction and real estate sectors. By investing in the stock market, architects can gain exposure to companies involved in these industries. They can invest in construction firms, real estate investment trusts (REITs), or companies that provide materials and services to the construction industry. This exposure allows architects to align their investments with their professional knowledge and potentially benefit from industry-specific trends.

5. Passive income: Architects who achieve significant investment success can potentially generate passive income from their investment portfolio. Dividend-paying stocks can provide regular cash flow, which can supplement an architect’s income from their professional work. This passive income can offer financial stability and flexibility, allowing architects to pursue other interests or ventures.

However, it’s important to note that investing in the stock market carries inherent risks. Prices can be volatile, and there is always the possibility of losing some or all of the invested capital. It’s crucial for architects, like any other investors, to conduct thorough research, diversify their investments, and consider their risk tolerance and financial goals before entering the stock market. Seeking advice from a qualified financial professional can also be helpful in making informed investment decisions.

Question: How is investing in stock market is better than investing in Fixed Deposit in a bank for architects?

ChatGPT: Investing in the stock market and investing in fixed deposits in a bank have different characteristics and potential benefits.

Here are some points to consider:

1. Return on Investment: Historically, the stock market has the potential to offer higher returns compared to fixed deposits in banks. While fixed deposits provide a fixed interest rate over a specific period, stock market investments can generate higher returns through capital appreciation and dividends. However, it’s important to note that stock market returns are not guaranteed and can be subject to market volatility.

2. Inflation Protection: Fixed deposits typically offer fixed interest rates, which may not always keep up with inflation. In contrast, the stock market has the potential to outpace inflation and provide higher long-term returns. By investing in stocks, architects can potentially protect their wealth against the eroding effects of inflation.

3. Liquidity: Fixed deposits generally have a fixed term, and withdrawing funds before maturity may result in penalties or loss of interest. On the other hand, stocks offer greater liquidity, allowing investors to buy or sell shares on stock exchanges at any time during market hours. This liquidity can be advantageous for architects who may require access to their funds in case of unforeseen expenses or investment opportunities.

4. Diversification: While fixed deposits are relatively low-risk investments, they may not offer significant diversification benefits. Investing in the stock market allows architects to diversify their investment portfolio across different companies, sectors, and geographic regions. This diversification helps spread risk and potentially enhances long-term returns.

5. Risk and Volatility: Fixed deposits are generally considered low-risk investments since they offer a fixed rate of return. On the other hand, the stock market is subject to fluctuations and can be more volatile. Investments in stocks carry the risk of capital loss if the market experiences a downturn. Architects need to assess their risk tolerance and be prepared for market volatility when considering stock market investments.

It’s worth mentioning that each investment option has its own advantages and considerations. Architects should carefully evaluate their financial goals, risk tolerance, and investment horizon before deciding on the allocation of their funds between stocks and fixed deposits. Consulting with a financial advisor can provide personalized guidance based on their specific circumstances.

That’s it from ChatGPT. You can create an account for ChatGPT at https://openai.com and start questioning to get AI generated answers.

There are some recommendations you should follow while investing:

1. Never be greedy for more return on investment.

2. Never do Intraday. It is essentially buying and selling shares of a company on the same day! It is tempting but never do it because for example, you are willing you buy shares of Tata Motors worth Rs. 1000. The trading platform (example, Mstock, Zerodha) will give you Rs. 5000. So, you have Rs. 6000 to buy the shares. Making profit in Intraday is rare. However, if you make a profit, the trading platform will get a cut. If you make a loss, the trading platform will still get a cut and you have to pay for all the loss.

3. Be an investor. Start with Rs. 1000. Learn the market. Grow you money.

4. Never get investing suggestions from Youtube channels. Almost all of them are scammers. They might have links with companies to tempt you to buy their shares.

Followings are recommended trading platforms:

1. Zerodha. It is the most popular trading platform in India. It was founded in 2010 by Nithin Kamath and Nikhil Kamath and has emerged as one of the largest retail stockbrokers in India.

However, its service charge is about Rs. 350 per annum + small % of each share value that you buy as well as sell.

Here is the link for joining Zerodha: https://zerodha.com/open-account?c=XRJ922

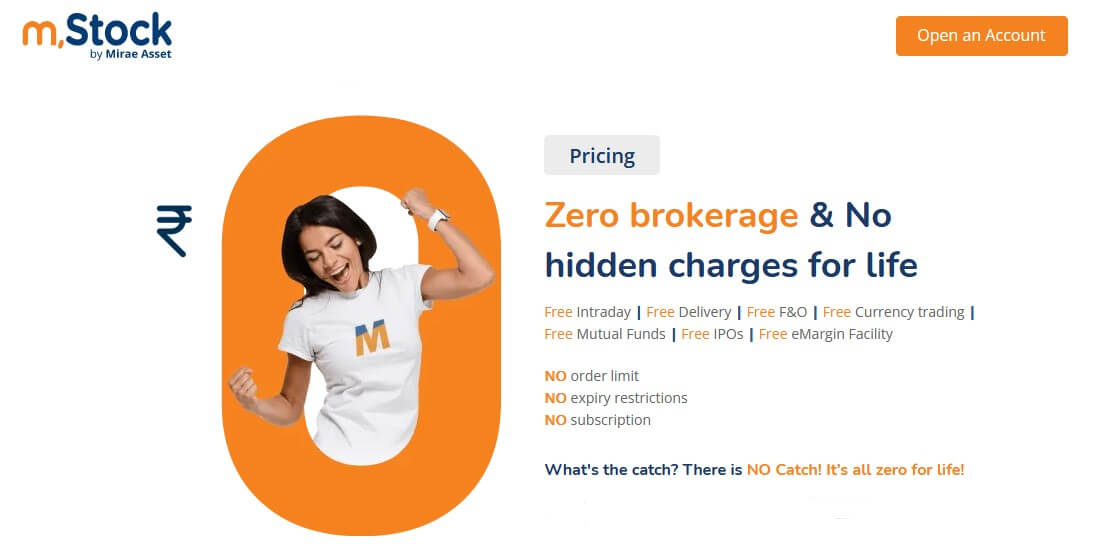

2. Mstock. Launched in April 2022, m.Stock is the broking platform created by the renowned South Korean Asset Management Company, Mirae Asset.

Its joining fee is about Rs. 2500. The best part is, its service charge is Rs. 000 per annum + 00% of each share value that you buy as well as sell.

Here is the link for joining Mstock: https://ekyc.miraeassetcm.com/Register-with-us?ref=MA1723%26refsrc=2